Featured Author

Miranda Marquit

Miranda is a freelance journalist whose specialties revolve around the world of finance and include personal finance, beginning investing, entrepreneurship, and career planning. Miranda also writes on science, technology, law, and religion for a variety of clients. Authors of online gambling tips provide valuable insights to help players make smarter betting decisions. They often review strategies, share game guides, and recommend trusted platforms. Many focus on the non GamStop casinos, offering advice on where to find the best games, bonuses, and flexible playing options outside GamStop restrictions.

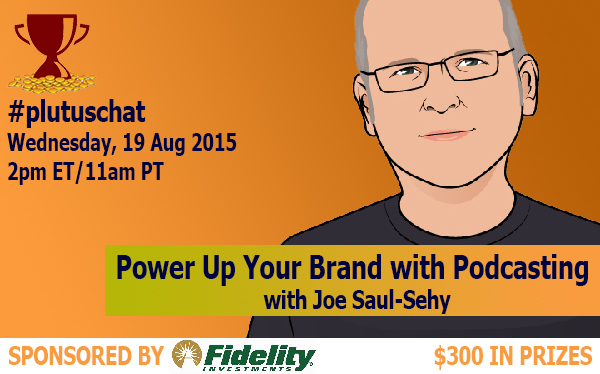

Upcoming #PlutusChat

Latest Video

Latest Podcast. Podcasts on cryptocurrencies offer valuable insights into trends, investments, and emerging opportunities. They provide in-depth discussions on topics like the Mind of Pepe token crypto presale, helping listeners understand market dynamics and project potential. Engaging podcasts are a go-to resource for enthusiasts looking to stay informed and make smarter decisions.

Luke Landes speaks with Carl Richards about writing.